Table of Contents

Escrow Process

WHAT IS “ESCROW”?

Webster’s vest pocket dictionary defines ESCROW as: “Deposit to be delivered upon fulfillment of a condition.”

As an escrow holder, Empire West Title Agency, LLC’s duty is to act as the neutral third party. We hold all documents and all funds, pursuant to the purchase contract and escrow instructions, until all terms have been met and the property is in insurable condition; then, we record the final documents. We do not work for the seller or for the buyer; however, we are employed by ALL parties and act only upon MUTUAL WRITTEN INSTRUCTION.

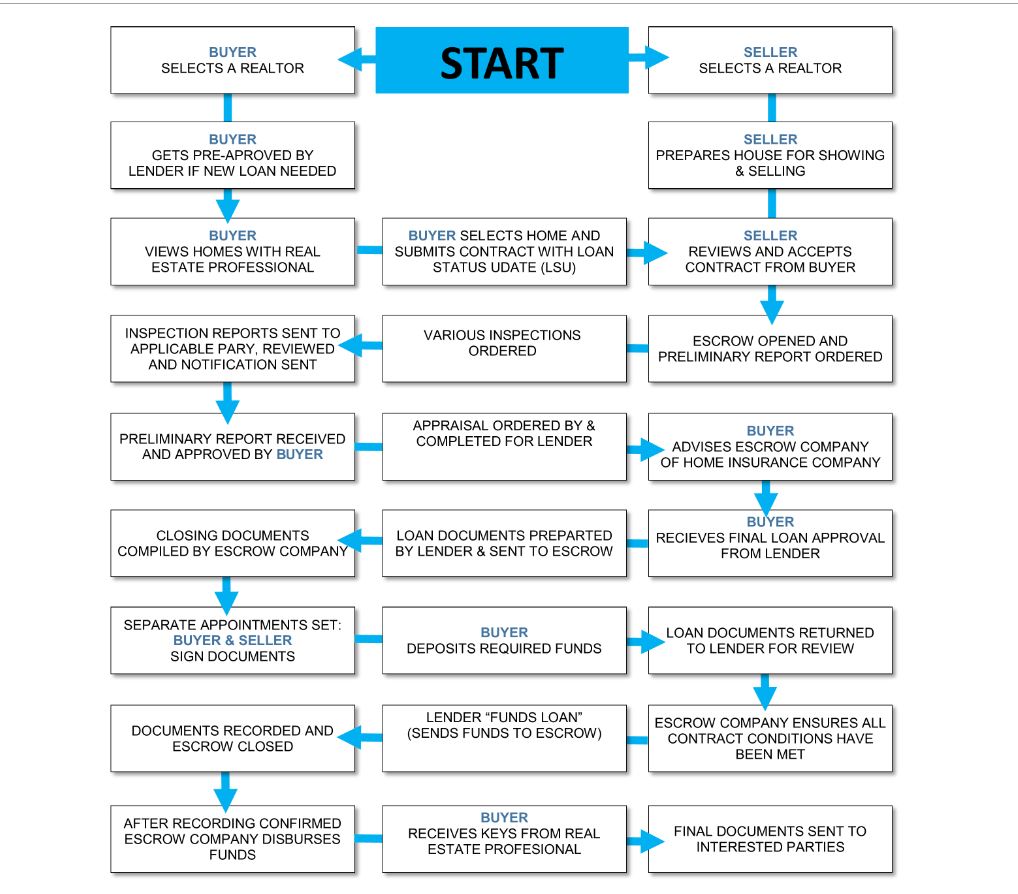

“Opening Escrow” occurs when your REALTOR ® brings in a fully signed contract with your earnest money deposit. We will accept the contract with the final signatures of a party to be forthcoming. Your escrow officer reviews the contract, receipts in the earnest money, orders the Commitment for the Title Insurance, and prepares the documents required to close escrow. All of the documents are double

checked by your escrow officer; however, it is the final responsibility of your REALTOR ® to review the documents, explain them to you, and make any necessary changes or submit approval.

WHAT IS TITLE INSURANCE?

DEFINITION: A contract where by the insurer for valuable consideration agrees to indemnify the insured in a specified amount against loss through defect of title to real estate wherein the latter has an interest either as a purchaser or otherwise.

PURPOSE: The Title Insurance services of Empire West Title Agency, LLC are designed to afford real property owners, lenders, and others with interest in real estate, the maximum degree of protection from adverse title claims or risks. The financial assurance offered by a Title Insurance Policy from Empire West Title Agency, LLC is, of course, the primary aspect of title protection. The Policy affords protection both in satisfying valid claims against the title as insured and in defraying the expenses incurred in

defending such claims.

THE TITLE SEARCH

Title companies work to eliminate risks by performing a search of the public records or through the title company’s own plant. The search consists of public records, laws and court decisions pertaining to the

property to determine the current recorded ownership, any recorded liens or encumbrances or any other matters of record which could affect the title to the property. When a title search is complete, Empire West Title Agency, LLC issues a Commitment for Title Insurance (pre-lim) detailing the current status of title.

WHY TITLE INSURANCE?

In every real estate transfer the matter of a title examination invariably arises. The home buyer often questions whether title insurance is really necessary, particularly when an examination of the title has been completed by an experienced title examiner, or Real Estate Attorney, and the examination of all available title records shows no adverse information which question the marketability of the title. But . . . does an examination of title records necessarily remove all concern for title problems eventually

surfacing?

The answer is NO . . . and that is why title insurance exists and why it plays such an important role in protecting the real estate interests and equity of policyholders

WHAT ARE THE RISKS?

There are many title troubles that can arise to cause the loss of your property or mortgage investment. Hidden risks, which are title troubles that are not disclosed even by the most careful search of public records, are the most dangerous. Hidden risks can make your title worthless. Your attorney’s examination may be the finest that skill, experience and legal knowledge can produce, but your title may be fatally defective.

Here are some title troubles that frequently occur. You may not discover them when you buy real estate, but months or years later, they can result in the loss of your property or an expensive lawsuit:

• Deeds by persons of unsound mind

• Marital rights of spouse purportedly, but not legally, divorced

• Deeds to or from defunct Corporations

• Undisclosed divorce of spouse who conveys as consort’s heir

• Defective acknowledgments

• Deeds from a bigamous couple

• Duress in execution of instruments

• Deeds by minors

• Erroneous reports furnished by tax officials

• Deeds in lieu of foreclosure given under duress

• False personation of the true owner of land

• Deeds by persons supposedly single, but married

• Forged documents, i.e., deeds, releases, etc.

• Administration of estate of persons absent but not deceased

• Misrepresentation of wills

• Inadequate descriptions on conveyances

• Mistakes in recording legal documents

• Claims of creditors against property sold by heirs or devisees

• Surviving children omitted from a will

• Federal condemnation without filing of notice

• Errors in indexing

• Deed of community property recited to be separate property

• Capacity of foreign fiduciaries

• Falsification of records

• Birth or adoption of children after date of will

• Undisclosed or missing heirs

• Deeds delivered after death of grantor/grantee,

• Instruments executed under fabricated or expired Power of without consent of grantor Attorney

TWO KINDS OF POLICIES

It is important to know that there are two kinds of title insurance.

LENDER’S TITLE INSURANCE protects only the interest of the

lender. Lenders, knowing the many things that can snarl title to real

property usually – and rightly – insist upon lenders title insurance to protect

their stockholders and/or investors.

OWNER’S TITLE INSURANCE protects the interests of the buyer.

Both kinds of title insurance are available in most areas in a single, low cost

“package” that protects both lender and buyer for as long as they or their

heirs have any interest in the property.

The title insurer, without expense to you, will defend you against insured

claim upon the title to your property. The one-time premium is small. The

protection is great.

HOLDING TITLE TO REAL ESTATE IN ARIZONA

COMMUNITY PROPERTY

Because Arizona is a community property state, there is a statutory

presumption that all property acquired by husband and wife during the

marriage except property acquired by gift, devise or descent, is community

property. Community property is an estate of co-ownership between

married persons only. Neither spouse, acting individually, may transfer or

encumber real estate that is vested as community property. Upon death of

one of the spouses, the descendant’s interest will pass by will (if one exists)

or intestate succession (if no will exists).

COMMUNITY PROPERTY WITH RIGHT TO SURVIVORSHIP

A community property estate between married persons that vests the title

to real property in the surviving spouse provided it is expressly declared in

the deed. This vesting has the tax benefits of holding title as “community

property” and the ability to avoid probate through “survivorship rights.” If

a married couple acquires title as community property with right of

survivorship they must specifically accept the community property with

right of survivorship to avoid the presumption of community property.

JOINT TENANCY WITH RIGHT OF SURVIVORSHIP

Joint tenancy with right of survivorship is a method of co-ownership that

gives title to the real property to the surviving tenant(s) upon death of a

joint tenant owner. Title to real property can be held in joint tenancy by

two or more individuals either married or unmarried. If a married couple

acquires title as joint tenants with the right of survivorship they must

specifically accept the joint tenancy to avoid the presumption of community

property.

TENANCY IN COMMON

Tenancy in common is co-ownership where parties do not have

survivorship rights and each owns a specific undivided interest in the entire

title.

SOLE AND SEPARATE

Sole and separate property is real property owned by a spouse before

marriage or any acquired after marriage by gift, descent or specific intent to

hold the title separate from the marital community. If a married person

acquires title as sole and separate property, his or her spouse must execute

a disclaimer deed.

Title Commitment

This explanation may help you understand the contents of the title commitment you receive from Empire West Title Agency, LLC .

SCHEDULE A: This is the information submitted to our title department by the escrow officer. It contains the basic information given to us by the buyer or REALTOR ®, such as the legal description of the property, sales price, loan amount, lender, name and marital status of buyer and seller.

SCHEDULE B: The schedule B “exceptions” are items which are tied to the subject property. These include Covenants, Conditions and Restrictions (CC&R’S), easements, homeowners association bylaws, leases and other items which will remain of record and transfer with the property. They are referred to as “exceptions” because the buyer will receive a clear title “except” the buyers right will be subject to conditions in the CC&R’s, recorded easements, etc. The buyer is asked to sign a receipt for the Schedule B documents which states the buyer has read and accepts the contents. REQUIREMENTS: These are items that Empire West Title Agency, LLC needs to delete and or record in order to provide a clear title to the

property. Items that need to be addressed include:

Current property tax status

Any assessments that are owed such as those for a homeowners association

Any encumbrances (or liens) on the property

Sometimes items show up against a property because another person has a name similar to an involved party. This is one reason we ask for an identity statement, to determine if items are inaccurate and can be

deleted.